In-depth Analysis of RWA: The “Seam” between the Crypto World and the Traditional World

New technologies give rise to new forms of industries.

Introduction: DeFi is gradually expanding the boundaries of cryptocurrency business and making an impact in the real world. RWA (Real-World Assets), considered to be the next growth engine for DeFi, is gaining momentum in the crypto world, reminiscent of the DeFi Summer of 2020. Apart from Binance, traditional financial institutions such as Goldman Sachs, Hamilton Lane, Siemens, and leading DeFi protocols like MakerDAO and Aave are actively positioning themselves in the RWA race.

Currently, there is an increasing frequency of discussions in the market regarding RWA (Real-World Assets), and some viewpoints suggest that RWA will trigger the next bull market. Some entrepreneurs have also adjusted their focus towards RWA-related tracks, hoping to leverage the gradually heating narrative to propel rapid business growth.

What exactly is RWA?

The full name of RWA is Real World Assets tokenization. It refers to the process of converting the value of tangible or intangible assets, along with any associated rights, into digital tokens. This enables the digital ownership, transfer, and storage of assets without the need for central intermediaries, with the value mapped onto the blockchain and traded. RWA can encompass both tangible and intangible assets.

This may sound ordinary, but let’s look at some numbers: the total value of global real estate is $360 trillion, the value of fixed-income bonds is $127 trillion, while the total market capitalization of the cryptocurrency market is only $1.18 trillion. If real-world assets gradually succeed in being tokenized, their market potential would be immeasurable.

In fact, RWA is not a new concept. Since the birth of blockchain, discussions about tokenizing real-world assets such as real estate, commodities, private equity, credit, bonds, and artwork have been common, and there have been several conceptual projects, but they haven’t made a significant impact.

Among them, BTM Bytom, which focuses on “asset on-chain,” can be considered one of the earliest RWA projects. However, being an early bird doesn’t always guarantee success. Currently, the most successful examples of RWA are digital dollars like USDT and USDC, which map the value of the U.S. dollar onto the blockchain and tokenize it. Stablecoins have subtly influenced the entire cryptocurrency industry and have become an important cornerstone.

Recently, Citigroup released a research report predicting that by 2030, there will be $4 trillion to $5 trillion in tokenized digital securities, and the trade finance transaction volume based on distributed ledger technology will reach $1 trillion.

Many traditional financial institutions and corporate giants are highly interested in RWA, making it a growing trend!

Why is RWA attracting so much attention?

At its root, the increasing demand for RWA stems from the underwhelming yields in the DeFi sector, which are failing to meet the growing profit demands of crypto users.

During the DeFi Summer period, it was well-known that the high yields of a bull market could satisfy the profit requirements of crypto investors. However, after experiencing significant market volatility and a sustained bull market, the Total Value Locked (TVL) in DeFi has decreased by over 70% from its peak in December 2021. DeFi yields have plummeted to a new low, prompting both DeFi protocols and crypto investors to seek new avenues for profit growth.

With the Federal Reserve’s continued interest rate hikes, the yields from investing in US bonds have far surpassed those of DeFi protocols. Established DeFi protocols such as Curve, Aave, and Compound have seen their yields drop from highs of over 10% to a range of 0.1% to 2%, while US bond yields have increased from 0.3% to 5%. Furthermore, US bonds carry fewer security risks compared to DeFi protocols.

Furthermore, in the long run, RWA presents significant opportunities to bridge traditional finance and crypto finance, opening up vast realms of imagination. The real assets in traditional finance, such as real estate and non-financial corporate debt markets, represent trillion-dollar markets. If DeFi can integrate with these markets, it can provide users with greater liquidity, capital efficiency, and investment opportunities.

Moreover, traditional finance suffers from various pain points, including high entry barriers, numerous intermediaries, and restrictions. For instance, private equity funds typically require a minimum investment capital of over $500,000, while real estate investments demand substantial capital support, making it nearly impossible for average investors to enter these markets. Additionally, they face high fees from intermediaries, restrictions imposed by regulatory bodies, and risks associated with third-party systems. RWA’s design can address some of these pain points in traditional finance, thereby attracting more investors to enter the realm of DeFi.

Clearly, RWA contributes to expanding the market size of DeFi and enables traditional financial institutions to explore new business models. Leading DeFi protocols are actively positioning themselves in the RWA space, while traditional financial institutions also show a keen interest in RWA.

RWA lowers the barriers between TradFi and DeFi, attracting more traditional capital into the DeFi market through tokenization. This expands the range of available assets in the DeFi market and promotes interoperability between traditional finance and the crypto industry. Simultaneously, RWA reduces the costs of financial transactions, eliminating complex intermediaries and fees. It also breaks geographical restrictions, enabling assets to circulate globally and creating a faster and simpler trading system.

How does RWA actually work?

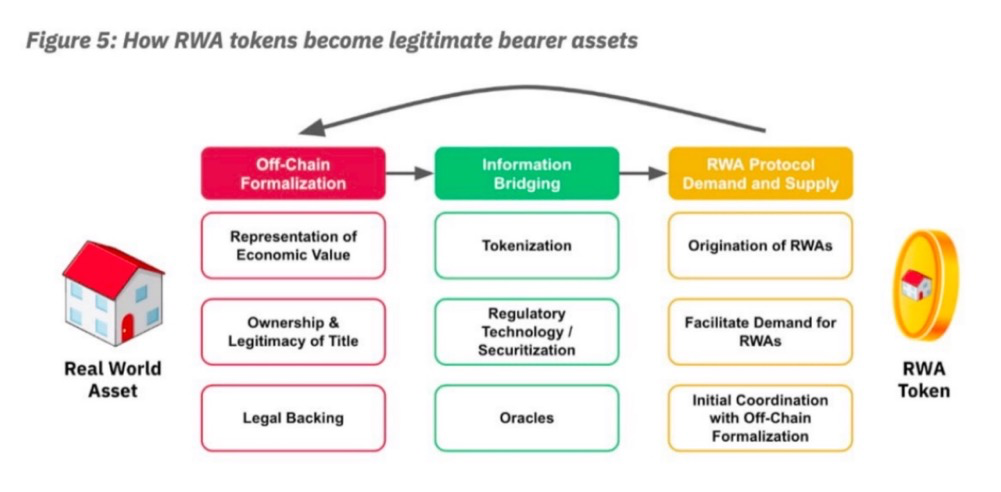

As mentioned earlier, RWA represents the tokenization of real-world assets in the off-chain world. It is crucial to clarify how asset ownership and value are transferred between the physical and digital realms, and how RWA can be explained as a legitimate representation of real-world assets. The process of tokenizing real-world assets, or RWA, can be divided into three stages:

(1) Off-Chain Formalization

(2) On-Chain Data

(3) RWA Protocol Demand and Supply

(1) Off-Chain Formalization:

To bring real-world assets into DeFi, the first step is to undergo off-chain formalization, where the assets are packaged and made compliant. This process involves ensuring clarity on the asset’s value, ownership, and legal protection of its rights and interests.

Representation of Economic Value: The economic value of an asset can be represented by its fair market value in traditional financial markets, recent performance data, physical condition, or any other economic indicators.

Ownership & Legitimacy of Title: The ownership of an asset can be determined through deeds, mortgages, bills of sale, or any other form of documentation that establishes legitimate ownership.

Legal Backing: In cases involving changes in asset ownership or rights, there should be a clear process for resolution, which typically includes specific legal procedures for asset liquidation, dispute resolution, and enforcement.

(2) Information Bridging

Next, the information regarding the economic value, ownership, and rights of the asset is digitized and brought onto the blockchain, stored in the distributed ledger of the blockchain.

Tokenization: After the off-chain stage of packaging, the information is digitized and represented by metadata within digital tokens. These metadata can be accessed through the blockchain, making the economic value, ownership, and rights of the asset fully transparent. Different asset categories can correspond to different DeFi protocol standards.

Regulatory Technology/Securitization: For assets that require regulation or are considered securities, they can be brought into DeFi through legal and compliant means. These regulations may include but are not limited to licensing for issuing security tokens, KYC/AML/CTF compliance, and compliance requirements for listing on exchanges.

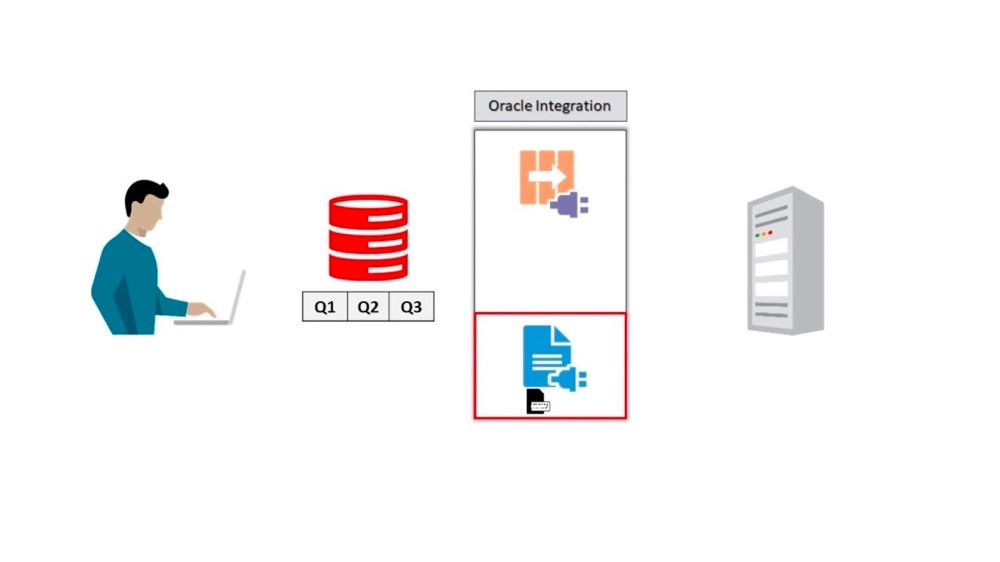

Oracle: For RWA, it is necessary to reference external data from the real world to accurately depict the value of the asset. For example, in the case of a stock RWA, access to the performance data of that stock is required. However, since the blockchain cannot directly fetch external data, oracle services like PlugChain are needed to bridge the on-chain data with real-world information. They provide data such as off-chain asset values to DeFi protocols.

(3) RWA Protocol Demand and Supply

DeFi protocols that focus on RWA drive the entire process of real-world asset tokenization. On the supply side, DeFi protocols oversee the formation of RWA. On the demand side, DeFi protocols facilitate investors’ demand for RWA. In this way, DeFi protocols specialized in RWA can serve as both the starting point for the formation of RWA and the market for the eventual products of RWA.

The Duality of RWA: Opportunities and Risks

Despite the many benefits of RWA, its sustained and large-scale development relies on the compliance of RWA. The current criticism of USDT, for instance, lies in its apparent centralization and lack of transparency regarding its underlying assets. Addressing how to bring real-world assets onto the blockchain, ensuring the authenticity and legality of assets while preventing money laundering and other illicit activities, is a challenging issue that needs to be resolved for the development of RWA. This will involve various legal, regulatory, and technological requirements.

It is important to note that the overall market size of real estate projects in RWA is currently very small, with challenges such as insufficient liquidity and poor transparency in mechanisms. It requires the involvement of large centralized entities to endorse and regulate these projects, as the utility tokens issued by related protocols have generally faced low acceptance in the crypto market. This is mainly due to the strict regulation that real-world assets require, as well as the complex operations needed to establish ownership of the assets.

In conclusion, the RWA space is still in its early stages and awaits gradual improvements in regulation and infrastructure. However, the narrative of RWA holds significant growth potential and may attract more traditional users into the world of DeFi and Web3 while being linked to real-world assets, thereby reshaping the landscape of the crypto market.

In conclusion,RWA offers diverse asset types and provides investors with more possibilities for diversified investments. However, improper financial regulation can potentially harm investor interests. Additionally, regulatory rules for RWA are unlikely to be established in the near future, and there is uncertainty in the regulatory environment, which requires further observation over a period of time.

PlugChain takes the aggregated cross-chain oracle protocol as the core, integrates the advantages of high performance, high expansion, low gas!

Website: https://plugchain.io

Twitter: https://twitter.com/Plugchainclub @Plugchainclub

Telegram: https://t.me/plugchain

Discord: https://discord.gg/GdpPzUt89E

Youtube: https://www.youtube.com/channel/UCW4s0YFA7y1qYis1eW3Wcog

Medium: https://officialplugchain.medium.com/

NFT Market:https://very5.com/

GitHub:https://github.com/oracleNetworkProtocol/plugchain

Official Email:officialplugchain@gmail.com

#PlugChain #Pando #Very5 #Gxswap #Oracle #prc20 #web3

Comments

Post a Comment