Faced with the SEC successive “strangulation” actions, where is the cryptocurrency industry heading?

Introduction: In recent days, two of the world’s largest cryptocurrency exchanges, Binance and Coinbase, have been sued by the SEC, and more than ten mainstream cryptocurrencies have been classified as securities and brought under SEC regulation. As a result, Bitcoin’s price plummeted over 5% within 24 hours of the news, breaking below the $26,000 mark. BNB also experienced a decline of over 10%, falling below the $300 mark. Other mainstream cryptocurrencies such as ETH, LTC, and XRP also saw varying degrees of decline.

Behind the SEC aggressive crackdown lies a pursuit of power.

On the evening of June 5th, Binance Holdings Limited (hereinafter referred to as “Binance”), a leading cryptocurrency exchange, and its CEO, Changpeng Zhao (CZ), were sued by the U.S. Securities and Exchange Commission (SEC) on allegations of violating securities trading regulations. This comes as another legal action against Binance and CZ, following their previous lawsuit by the U.S. Commodity Futures Trading Commission (CFTC) on March 28th for alleged violations of trading and derivative rules. The latest lawsuit has sparked significant volatility in the cryptocurrency market.

On June 6th, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the cryptocurrency exchange Coinbase in the New York federal court, alleging that it operated an unregistered trading platform and its lending services were unregistered.

According to the SEC, Coinbase has generated billions of dollars in revenue but lacked the necessary registration, disclosure, and investor protection measures. The lawsuit claims that since 2019, Coinbase has been operating as an unregistered broker-dealer, including activities such as soliciting potential investors, handling customer funds and assets, and charging transaction-based fees. It also alleges that Coinbase operated as an unregistered trading platform, providing a marketplace that brought together multiple buyers and sellers of cryptocurrencies and matched and executed these orders.

The precise nature of the allegations shows that the SEC has targeted the gray area of “identifying certain cryptocurrencies as unregistered securities,” explicitly mentioning more than ten prominent tokens. It is evident that following the FTX incident, the SEC has demonstrated its determination to regulate and its thorough research into the regulatory field and policies.

Looking from a different perspective, having reasonable regulatory policies can indeed be beneficial for investors and platform users. It helps to standardize the behavior of exchanges, protect the security of funds, and mitigate the impact and damage caused by incidents like the FTX scandal to the financial industry. To achieve this, there needs to be an authoritative and professional regulatory body that can hold significant influence over the cryptocurrency world, and the SEC aims to play that role.

As Chairman Rostin Behnam of the Commodity Futures Trading Commission (CFTC) rightly pointed out, the regulation of crypto assets is currently in a vacuum. Thus, the regulatory agency that gains a first-mover advantage can not only wield more power and authority but also enjoy evident benefits. For regulatory bodies, finding their own “cash cow” becomes increasingly important in a context where the United States is facing a severe fiscal deficit and the nation is engaged in discussions about the debt ceiling.

The dispute between the SEC and CEX has been long-standing.

In general, there are two common ways for disputes to arise between CEX (cryptocurrency exchanges) and the SEC. One way is when the exchange engages in illegal securities trading operations, offering unregistered securities.

As early as April this year, the SEC filed a lawsuit against Bittrex Inc., alleging the operation of an unregistered securities exchange. Any reasonable interpretation of the Bittrex case clearly indicates that similar cases may also be brought against Coinbase and Binance. In the eyes of the SEC, any cryptocurrency exchange operating in the United States is considered illegal.

The other unfavorable way is when troubles arise due to the misappropriation of customer funds. In December of last year, the SEC filed a lawsuit against a major cryptocurrency exchange, FTX Trading Ltd. This was the SEC accusation against FTX, alleging that the exchange had misappropriated customer funds. When an exchange engages in fund misappropriation, the SEC focuses on this aspect. When not all funds are misappropriated, the SEC pays attention to the issue of operating an unregistered securities exchange.

Therefore, a question arises: Is the SEC suing Coinbase and Binance because they are cryptocurrency exchanges, or because they are malicious cryptocurrency exchanges? Furthermore, are the accusations based on “allowing people to trade cryptocurrencies, which we believe is illegal,” or “attracting people to trade cryptocurrencies and misappropriating their funds”?

Additionally, the SEC clarified its position in the lawsuit, stating that most crypto tokens — excluding BTC, but including a majority of them — are considered securities under U.S. law. Coinbase, on the other hand, argues that many of these tokens are not securities. The key issue in this matter revolves around the classification of popular crypto tokens mentioned by the SEC, including SOL (Solana), ADA (Cardano), MATIC (Polygon), FIL (Filecoin), MANA (Decentraland), ALGO (Algorand), AXS (Axie Infinity), and VGX (Voyager Digital), whether they should be classified as securities or not.

Despite the regulatory FUD (Fear, Uncertainty, and Doubt), Robinhood immediately announced that it would delist tokens defined as securities within a week. Binance.US, which also faced an asset freeze request from the SEC, delisted over a hundred token trading pairs in a single night. However, in reality, it is unlikely that these two lawsuits will achieve any substantial results in the short term. The SEC is well aware of this fact, considering that even the Ripple case has been dragging on for several years, let alone taking on the industry giants.

During last week’s hearing, Rostin Behnam, the Chairman of the Commodity Futures Trading Commission (CFTC), stated, “The SEC has authority over assets classified as securities. But in fact, the largest token, Bitcoin, is considered a commodity, as determined by US courts. And under US law, it is unregulated… Given that most crypto commodity assets listed on trading platforms are rarely formally classified as commodities, there is an urgent need to grant regulatory agencies additional power in the field of crypto commodities.”

It is worth noting that in Behnam’s statement, he did not use the term “digital assets” but rather “digital commodity assets.” Behnam acknowledges that the SEC has regulatory authority over all assets classified as securities but does not agree that cryptocurrencies should be classified as securities. Throughout his speech, Behnam implies that only by allowing the CFTC to regulate cryptocurrencies as commodities can the regulatory vacuum currently present in the industry be addressed.

The question remains whether the crypto tokens listed on Binance and Coinbase are indeed securities. If they are deemed securities, then it is likely that Coinbase, Binance (along with Bittrex and other exchanges) are operating as illegal securities exchanges. However, if they are not securities, then there would be no issue.

Clearly, this will be a protracted tug-of-war that greatly impacts the future direction of the crypto market.

The scale of regulation depends on what is deemed reasonable and appropriate.

Due to the sudden regulatory accusations from the SEC, and the fact that both Binance and Coinbase, as influential platforms in the crypto industry, are the targets of these accusations, investors have become extremely sensitive to risks, especially considering the shadow cast by the FTX incident last year.

According to data, there was a slight increase in decentralized exchange (DEX) trading volume on June 6th and 7th. This indicates that investors are moving their assets out of the market, suspending mining and staking activities, and adopting a temporary wait-and-see approach to mitigate risks.

Many international media outlets and industry experts have come out in support of Binance and Coinbase, expressing their trust and confidence in these platforms. The market uproar and price fluctuations have caused dissatisfaction among many people.

Blockworks, in a direct column, criticizes SEC Chairman Gary Gensler, accusing him of harming the interests of the nation and its people. They argue that his aggressive policies, which expose his insufficient ability to regulate cryptocurrencies, are stifling innovation. The prominent media figures believe that digital assets are an inevitable trend, and if the SEC continues to employ a regulatory approach that involves “I suspect you are involved, I accuse you first, but I haven’t provided direct evidence publicly,” they are essentially driving the Web3 revolution out of the United States.

It seems that the SEC and CEX (cryptocurrency exchanges) conflict has escalated to the point where on June 13th, US Representative Warren Davidson from Ohio announced on social media his intention to introduce legislation to remove SEC Chairman Gary Gensler from his position. In his tweet, Davidson mentioned the need to protect the US capital markets from the influence of the SEC Chairman and proposed a single legislation to address ongoing abuses of power and safeguard the market’s best interests in the coming years. He believes that now is the time for genuine reform and to dismiss Gary Gensler from his role.

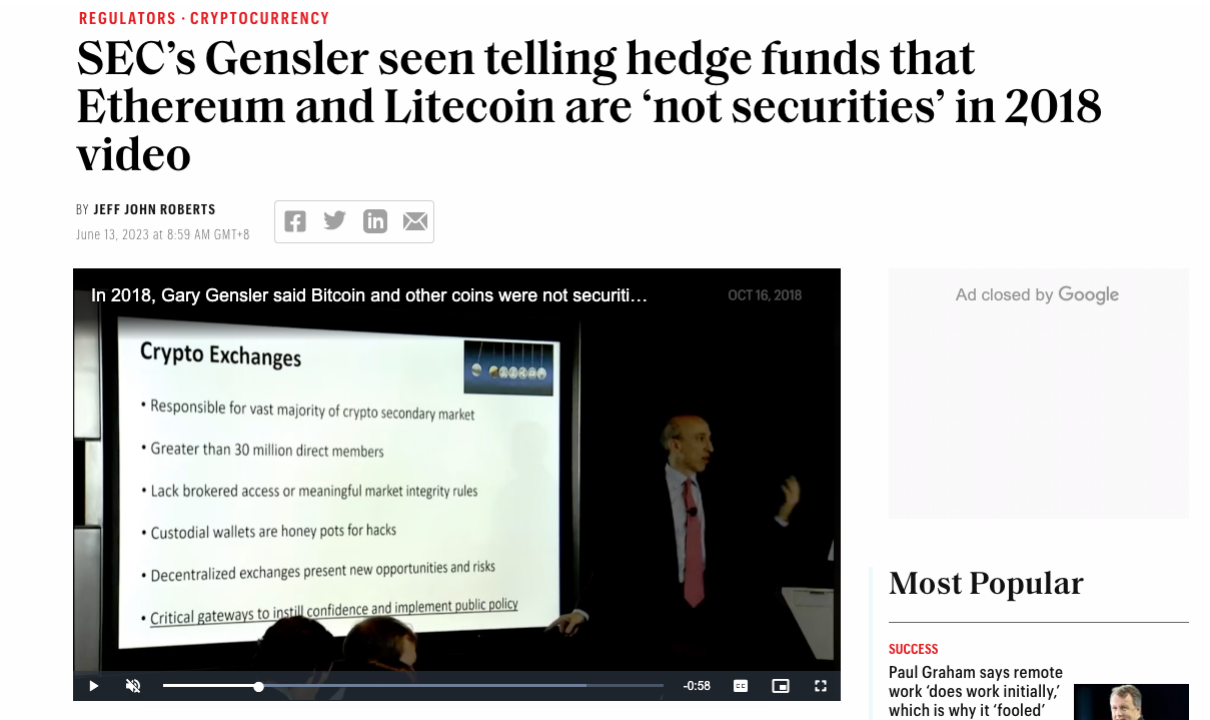

Furthermore, there have been reports that Gary Gensler had significantly different views on cryptocurrencies in the past. According to Fortune magazine, during a cryptocurrency-focused institutional investor event hosted by Bloomberg and Fidelity in 2018, Gensler stated that Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) were not securities.

The conflict between the SEC and CEX has spread throughout the entire crypto industry, and there are growing concerns and controversies surrounding Gary Gensler’s stance and actions.

Indeed, while many industry professionals strongly oppose what they perceive as the SEC’s heavy-handed interference in the crypto industry, there are market analysts who believe that the SEC’s actions represent a meaningful step towards regulated cryptocurrency market infrastructure in the United States. They argue that this shift could help the industry progress and move forward.

In this context, the author of the statement supports regulation but hopes that the SEC’s regulatory efforts are proportionate and balanced, rather than excessively strict. It is important to note that within the crypto world, there are still many promising projects that are shaping the narrative of the industry. Emerging public chains such as zkSync, Arbitrum, PlugChain, and Optimism are actively contributing to the development of the crypto world’s infrastructure. They are gradually laying the groundwork for the industry’s growth and evolution.

In conclusion, overall, SEC regulation is beneficial for the cryptocurrency industry, as it prevents Binance from becoming another FTX. Given its large scale, the consequences could be unimaginable if regulation cannot keep up. This is likely a consideration behind the logic of US regulators. Clearly, regulation is not aimed at destroying Binance, but rather, if Binance engages in similar behavior as FTX, relevant information will certainly be uncovered.

On the contrary, as Nietzsche once said, “What doesn’t kill me, makes me stronger.” For Binance, this might be seen as a test and an opportunity.

Comments

Post a Comment